Pioneering States: Colorado and Oregon's Cannabis and Psilocybin Reforms in Late 2025

In late 2025, Colorado and Oregon stand out as trailblazers in U.S. substance policy reform, each balancing thriving cannabis industries with innovative therapeutic psilocybin programs. With the recent federal rescheduling of cannabis to Schedule III via President Trump's December 18 executive order, these states are poised for further growth, reduced federal conflicts, and expanded opportunities in regulated markets. This overview compares their approaches, highlighting regulations, challenges, and shared security needs for businesses.

Colorado: Mature Cannabis with Emerging Psilocybin Access

Colorado pioneered recreational cannabis in 2012 and is now rolling out psilocybin healing centers.

Cannabis Highlights:

- Industry value: Over $1.5 billion annually.

- Possession: Up to 2 oz public, home grow 6 plants.

- Dispensaries: 1,000+ licensed, strict testing and taxes.

Psilocybin Highlights:

- Therapeutic sessions only (no sales/take-home).

- Licenses issued in 2025; costs $1,500–$4,000 per package.

- Focus on mental health and harm reduction.

Visuals of Colorado's landscapes and facilities.

Oregon: First Psilocybin Program Alongside Established Cannabis

Oregon launched the world's first regulated psilocybin services in 2023, paired with a robust cannabis market since 2014.

Cannabis Highlights:

- Generates $1+ billion yearly.

- Possession: 1 oz public, home grow 4 plants.

- Regulated sales with emphasis on equity and testing.

Psilocybin Highlights:

- ~24 service centers, 374 facilitators.

- Supervised sessions (6–8 hours), strong safety data.

- Ongoing refinements for accessibility.

Explore Oregon's natural inspiration and program elements.

Side-by-Side Comparison: Cannabis vs. Psilocybin Models

Both states keep frameworks separate—no co-sales—but differences are stark.

| Aspect | Cannabis (Both States) | Psilocybin (Colorado/Oregon) |

|---|---|---|

| Access Model | Retail dispensaries + home grow | Supervised therapeutic sessions only |

| Take-Home Allowed | Yes | No |

| Oversight | Commercial-focused (MED/OLCC) | Health-focused (DORA/OHA) |

| Primary Purpose | Recreational/Medical | Wellness/Mental Health Therapy |

Comparative insights and policy visuals.

Security Implications: Shared Needs in Growing Markets

Overlaps in cultivation, storage, and compliance create opportunities for security providers. Robust systems—surveillance, vaults, tracking—are essential to meet regulations and protect assets.

These states model evidence-based reform, influencing national trends amid federal changes. For detailed sections on each state, see the full articles below—or let me know if you'd like expansions!

Colorado's Cannabis and Psilocybin Landscape in Late 2025: Pioneering Reforms and Emerging Opportunities

As of December 20, 2025, Colorado continues to lead the nation in progressive drug policy, with established cannabis markets and a nascent psilocybin program rolling out. The state, which pioneered recreational cannabis legalization in 2012, is now implementing regulated access to psilocybin (the active compound in "magic mushrooms") for therapeutic use following voter approval in 2022. Recent federal shifts, including President Trump's executive order rescheduling cannabis to Schedule III, add momentum. This article explores current regulations, updates, and implications for businesses and users.

Cannabis in Colorado: A Mature Market with Federal Tailwinds

Colorado's cannabis industry, valued at over $1.5 billion annually, has been a model for regulated markets since Amendment 64 legalized recreational use for adults 21+ in 2012. Medical cannabis has been available since 2000. Key regulations include:

- Possession and Use: Adults can possess up to 2 ounces of flower (or equivalent in concentrates/edibles), grow up to 6 plants at home (3 mature), and consume privately. Public use is prohibited, with fines up to $100.

- Sales and Licensing: Over 1,000 licensed dispensaries operate under the Marijuana Enforcement Division (MED). Products must be lab-tested for potency and contaminants, with child-resistant packaging and advertising restrictions (e.g., no targeting minors). Taxes include a 15% excise tax plus state/local sales taxes, funding schools, infrastructure, and public health.

- Recent Updates: Revised MED rules effective December 4, 2024, address operational efficiencies, with further changes set for January 5, 2026. On December 18, 2025, President Trump signed an executive order directing the DOJ to reschedule cannabis from Schedule I to III, easing banking, research, and tax burdens (e.g., ending IRS Section 280E deductions ban). Governor Jared Polis hailed this as "smart policy," potentially boosting Colorado's industry by reducing federal-state conflicts.

Challenges persist, including market saturation and black market competition, but the rescheduling could attract more investment and normalize operations.

Psilocybin Program: Launching Therapeutic Access

Under the Natural Medicine Act (Proposition 122, passed in 2022), Colorado is establishing a regulated framework for psilocybin and other natural psychedelics (e.g., ibogaine, mescaline) focused on supervised therapeutic sessions—not recreational sales. The program emphasizes harm reduction and mental health benefits.

- Licensing and Rollout: License applications opened December 31, 2024, for healing centers, facilitators, and cultivators. The Department of Regulatory Agencies (DORA) oversees facilitators and centers, while the Department of Revenue handles cultivation and testing. First licenses were issued in early 2025, with centers like those in Boulder opening for sessions. Costs range from $1,500–$4,000 per session package, with waitlists growing (e.g., one center reported 200+ clients).

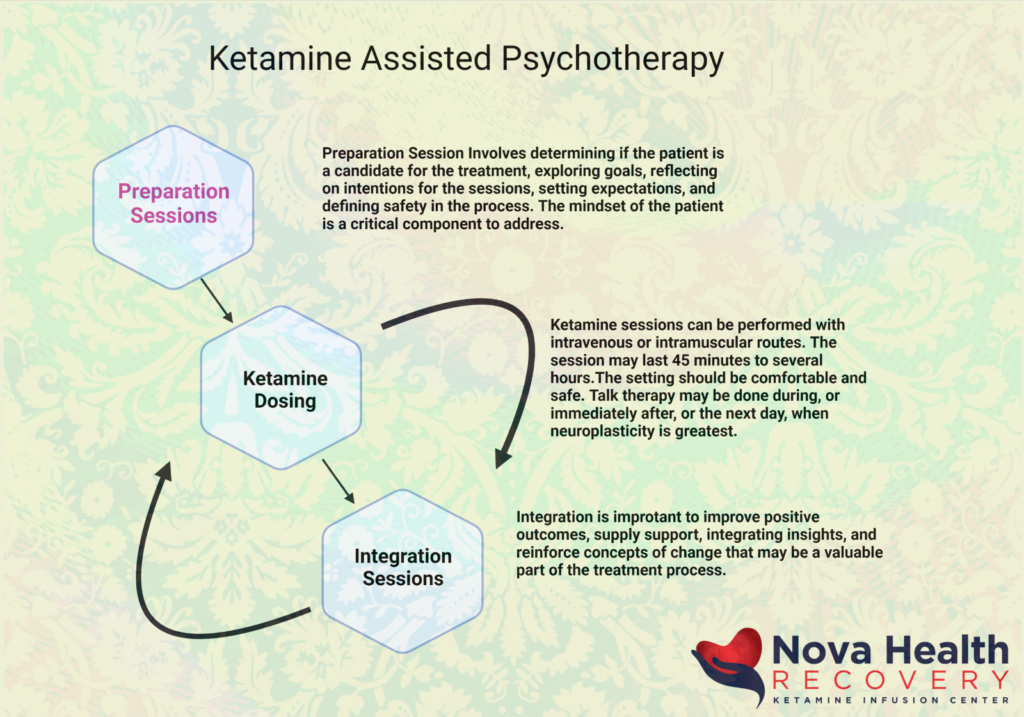

- Process and Safeguards: Adults 21+ can access psilocybin at licensed healing centers under trained facilitators. Sessions include preparation, administration (on-site only, no take-home), and integration. No medical diagnosis required, but health screenings ensure safety. Regulations mandate secure storage, equity in licensing, and data reporting on outcomes.

- 2025 Updates: The program is fully operational, with a 2025 Working Group report addressing federal integration (e.g., with VA programs). Exposure cases are monitored, showing low risks in regulated settings. Businesses are preparing for expansion, with 2025 dubbed "the year of Colorado psilocybin."

Unlike cannabis dispensaries, psilocybin centers are therapeutic facilities, not retail outlets, reducing commercialization risks.

Intersections and Security Considerations

While cannabis and psilocybin operate under separate frameworks—no co-sales allowed—overlaps exist in supply chains and security needs. Both require robust compliance: video surveillance, access controls, and inventory tracking to prevent diversion. For cannabis companies eyeing psilocybin, hybrid security solutions (e.g., for cultivation sites) could streamline operations amid federal easing. As markets grow, prioritizing cybersecurity and physical protections is key for canna-secure providers.

Outlook: A Model for the Nation

Colorado's dual reforms highlight a shift toward evidence-based policies, with cannabis generating billions in revenue and psilocybin addressing mental health crises. Federal rescheduling could harmonize rules, but challenges like affordability and equity remain. As 2026 approaches, watch for expanded psychedelic access and integrated wellness models.

Oregon's Cannabis and Psilocybin Landscape in Late 2025: Leading the Way in Regulated Access

As of December 20, 2025, Oregon stands as a pioneer in U.S. drug policy reform, with mature recreational and medical cannabis markets alongside the nation's first regulated psilocybin services program. Voters legalized recreational cannabis via Measure 91 in 2014 and psilocybin therapy through Measure 109 in 2020. Recent federal shifts, including President Trump's executive order rescheduling cannabis to Schedule III, provide tailwinds for the industry.

Cannabis in Oregon: A Thriving Regulated Market

Oregon's cannabis sector generates over $1 billion annually, with thousands of licensed businesses. Medical cannabis dates back to 1998, while recreational sales began in 2015.

- Possession and Use: Adults 21+ can possess up to 1 ounce in public (2 ounces at home), grow up to 4 plants per household, and consume privately. Public use carries fines.

- Sales and Licensing: Regulated by the Oregon Liquor and Cannabis Commission (OLCC), with strict testing, labeling, and tracking requirements. Taxes fund education, health, and local governments.

- 2025 Updates: The federal rescheduling eases banking and tax issues, potentially boosting growth amid market maturity and competition.

These visuals highlight key market stats and historical context.

Psilocybin Services: The First-in-Nation Therapeutic Model

Oregon Psilocybin Services (OPS), under the Oregon Health Authority, launched in 2023—no retail sales, only supervised sessions at licensed centers.

- Process Overview: Clients undergo preparation, on-site administration (6–8 hours), and optional integration. No diagnosis required; open to adults 21+.

- Infrastructure: Around 24 service centers and 374 facilitators licensed, with ongoing data tracking showing strong safety and thousands served.

- Challenges and Progress: Center closures due to costs, but program focuses on equity, research, and refinement in 2025.

Explore the therapy process and program tracker below.

Key Differences: Cannabis vs. Psilocybin Regulations

While both are state-legal, models differ sharply—cannabis is retail-focused, psilocybin therapeutic.

| Aspect | Cannabis | Psilocybin |

|---|---|---|

| Access Model | Dispensary sales & home grow | Supervised sessions only |

| Take-Home Allowed | Yes | No |

| Oversight | OLCC (commercial) | OHA (health-focused) |

| Purpose | Recreational/Medical | Wellness/Therapeutic |

Insights into comparative effects and policy parallels.

Security and Business Implications

Separate frameworks mean no co-sales, but shared needs for compliance—secure storage, surveillance, and tracking. For security providers, opportunities abound in protecting cultivation, centers, and supply chains amid growth.

Oregon's reforms continue influencing national trends. Stay informed via official sources, as rules evolve.