Cannabis and Psychedelics Co-Sales In Dispensary

As of December 20, 2025, cannabis and psychedelics (such as psilocybin) are not legally sold in the same stores or dispensaries in the United States. While both substances have seen regulatory progress, their frameworks remain distinct, with psychedelics typically limited to supervised therapeutic or medical administration rather than retail sales. Below, I'll break this down based on current trends and regulations in key states.

Current Status of Co-Sales

- No Legal Co-Location: In states where psychedelics have been decriminalized or regulated (e.g., Oregon, Colorado, New Mexico), psychedelics are handled through specialized programs or centers focused on medical or facilitated use. These are separate from cannabis dispensaries, which operate under retail models for medical and/or recreational cannabis. For instance:

- Oregon: Psilocybin is available only at licensed psilocybin service centers for supervised sessions, not for take-home sales. These centers are regulated by the Oregon Health Authority and cannot be co-located with cannabis dispensaries.

- Colorado: Natural medicine (including psilocybin) is administered at licensed healing centers under the Division of Professions and Occupations. Regulations prohibit integration with cannabis retail operations, emphasizing therapeutic settings over dispensary-style sales.

- New Mexico: The Medical Psilocybin Program, effective since June 2025, allows administration by licensed healthcare providers in approved medical settings for qualifying conditions like PTSD or depression. It does not involve dispensaries and explicitly requires clinician oversight, with no provisions for co-location with cannabis stores.

- Gray Market Exceptions: Some illegal or unregulated cannabis shops in areas like Southern California have been reported to sell psychedelics (e.g., psilocybin mushrooms or infused products) alongside cannabis, but this is not legal and carries enforcement risks. Federal law still classifies most psychedelics as Schedule I substances, prohibiting commercial sales.

Proposals exist for future integration—such as using existing cannabis infrastructure for psychedelics to reduce costs and speed up access—but these are not yet implemented anywhere. States are cautious to avoid blending the two due to differing safety profiles, federal restrictions, and public health concerns.

Regulations for Dispensaries

Since cannabis and psychedelics aren't sold together legally, cannabis dispensaries haven't faced new regulations specifically "because of" psychedelics. However, dispensaries must adhere to evolving state and federal cannabis rules, especially following the December 18, 2025, executive order rescheduling cannabis to Schedule III. Key requirements include:

- Licensing and Operations: Dispensaries need state-issued licenses, with strict rules on product testing, labeling, packaging, and age verification (21+ for recreational). They must track inventory via seed-to-sale systems to prevent diversion.

- Tax and Banking Changes: Post-rescheduling, dispensaries can deduct business expenses under IRS rules (ending Section 280E penalties) and access more banking services, but they remain subject to state taxes (e.g., 15-20% excise in many states).

- Product Restrictions: No sales of unregulated items like psychedelics; violations could lead to license revocation. Hemp-derived products (e.g., Delta-8) face tighter controls under updated federal hemp rules.

- Security and Compliance: Mandatory video surveillance, secure storage, employee background checks, and advertising limits (e.g., no targeting minors).

- State Variations: In recreational states like California or New York, dispensaries can sell cannabis flower, edibles, and concentrates, but psychedelics fall under separate health department oversight if legalized.

If psychedelics were to be integrated in the future (e.g., through bills in states like California or Massachusetts), dispensaries might need dual licensing, additional training for staff on psychedelic risks, and segregated sales areas to comply with therapeutic models. For now, the separation keeps regulations siloed.

Regulations change rapidly—check state health departments for the latest.

Oregon's Psilocybin Program: Details as of December 2025

Oregon made history with Measure 109 (passed in 2020), becoming the first U.S. state to establish a regulated framework for psilocybin services. The Oregon Psilocybin Services (OPS) section of the Oregon Health Authority (OHA) oversees licensing, manufacturing, testing, and supervised administration of psilocybin for adults 21+. This is not a retail dispensary model—psilocybin can only be consumed on-site at licensed service centers during guided sessions, with no take-home products allowed.

How It Works: The Client Process

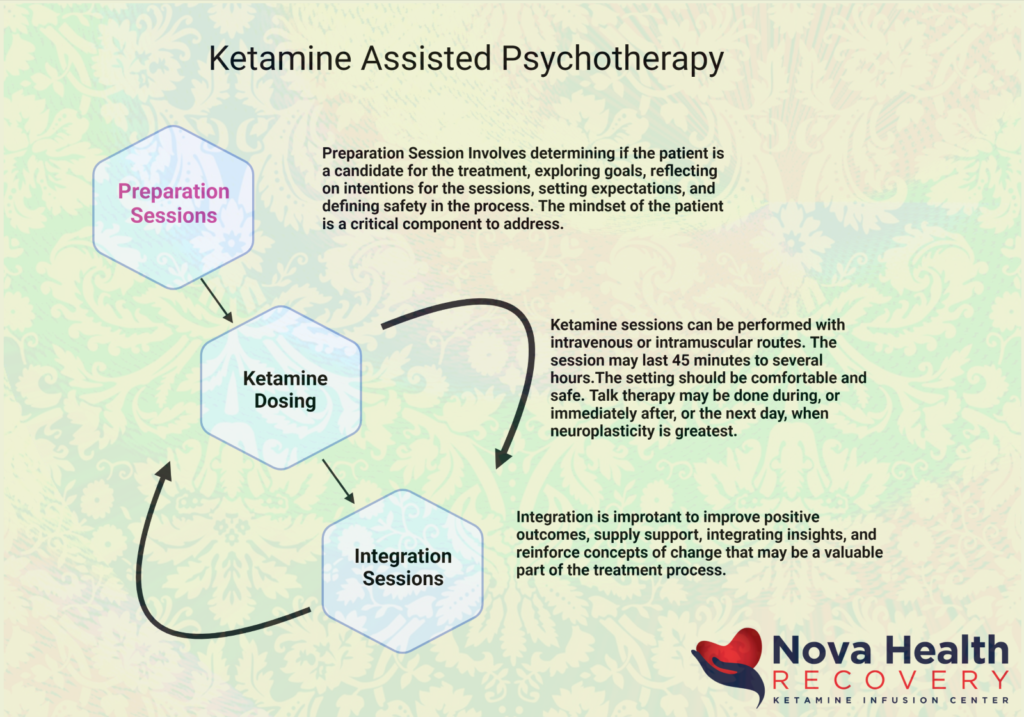

- Preparation Session — Clients meet with a licensed facilitator for screening, education, and planning (including a safety/support plan and transportation plan—no driving after sessions).

- Administration Session — At a licensed service center, clients consume psilocybin products under supervision. Sessions last 6–8 hours; facilitators provide non-directive support.

- Integration Session (optional but recommended) — Follow-up to process the experience.

No prescription or diagnosis is required—access is open to any adult 21+ who completes preparation and is deemed suitable.

Licensing and Infrastructure

- Service Centers → ~24 licensed (down from a peak of ~30–35 due to closures from high costs and regulations).

- Facilitators → ~374 licensed (must complete OHA-approved training, pass an exam, and meet residency/background requirements; residency rule ended in 2025).

- Manufacturers and Labs → A handful licensed for production and testing.

- Clients find centers via the OPS Licensee Directory; contact centers directly for scheduling and pricing (varies widely, often $1,200–$3,000 per full package).

Current Status and Data (2025)

- Sessions began in summer 2023; by mid-2025, thousands of clients served with low adverse events (e.g., only 13 emergency reports total through early 2025, and minimal in Q1/Q2).

- Q1 2025: 1,509 clients; average dose ~24–35 mg psilocybin.

- Safety record strong: Rare behavioral/medical reactions; no product recalls in early 2025.

- Data collection (via SB 303, started Jan 2025) tracks demographics, motivations (e.g., mental health, personal growth), and outcomes via an interactive OPS Data Dashboard.

Challenges and Recent Updates

- Closures and Sustainability — High operational costs, regulations, and demand mismatches led to ~1/3 of centers closing.

- Access Issues — Geographic gaps (many rural/eastern counties opted out); affordability barriers; stigma persists.

- 2025 Rule Changes — Updated training requirements, data forms (clients can opt out), and operational rules (e.g., temporary limits on hours for off-site uses). Public comment periods ongoing into December 2025.

- Focus shifting to equity, research (e.g., longitudinal studies), and fine-tuning for long-term viability.

The program remains a pioneering therapeutic model, emphasizing safety and facilitation over commercialization. For the latest, check the official OPS website or Licensee Directory—rules evolve quickly! If you're considering access or have questions about a specific aspect, let me know.